Calculating child support when your income fluctuates can feel overwhelming.

Whether you’re a sales executive with quarterly bonuses, a real estate agent riding market cycles, or a business owner with irregular cash flow, understanding how California calculates your child support obligations provides crucial clarity for your financial planning.

How is Child Support Determined in California?

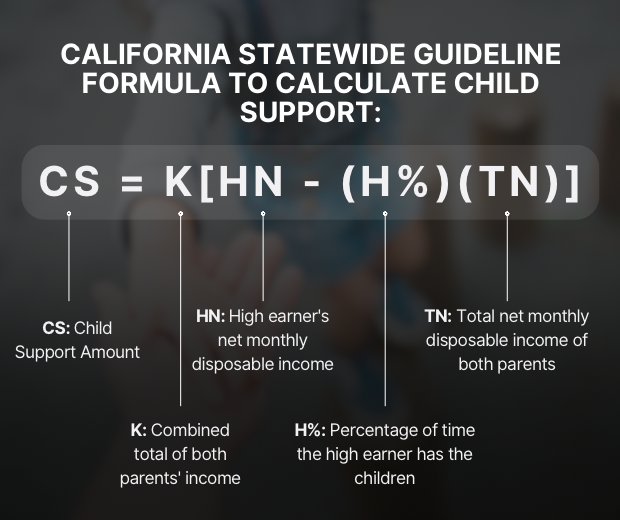

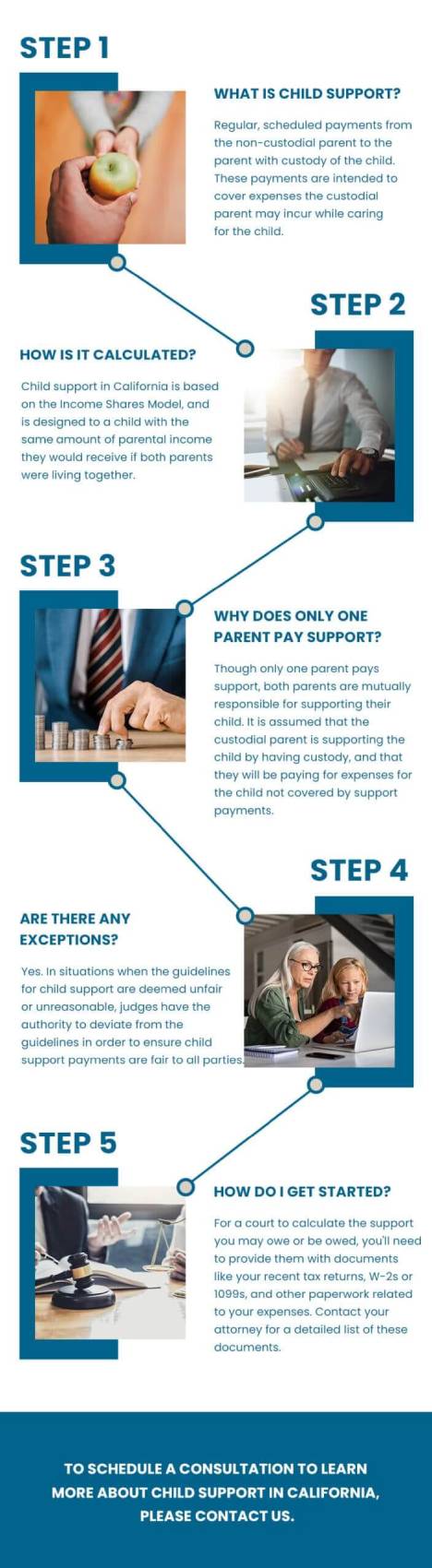

California uses a statewide guideline formula to calculate child support which considers factors like both parents’ incomes, how much time each parent spends with the children, and specific expenses.

Essentially, the calculation balances each parent’s financial contribution and the time they spend caring for their children. The more time a parent spends with the children, the less their financial obligation will typically be.

California law also recognizes that not everyone has a stable 9-to-5 job with predictable monthly paychecks. Freelancers, small business owners, commission-based professionals, medical practitioners with private practices, and financial advisors all fall into the category of variable income earners.

One of the primary challenges is determining what constitutes a reliable income base. Your income may depend on the market, client payments, seasons, or other unpredictable factors. This makes it tricky for the courts to assess what you should pay consistently, without overburdening you during lean months or leaving gaps during more lucrative times.

What many successful professionals don’t initially realize is that California courts look beyond base salary. That quarterly bonus? Those year-end commissions? That profit-sharing distribution?

They all factor into the calculation. The court’s primary concern is maintaining your children’s standard of living across both households.

How Does the State Determine Child Support for Variable Income?

California courts examine multiple factors:

- Actual Earned Income from All Sources: Beyond your regular paycheck, courts consider everything from bonuses and commissions to investment income and business profits. This comprehensive view ensures all financial resources are factored into support calculations.

- Time-share with Children: The percentage of time you have physical custody of your children affects how much you pay in child support. Generally, the more time you spend with your children, the lower your support payment may be, since you’re directly covering more of their daily expenses during your parenting time – like meals, activities, and incidentals.

- Tax Filing Status: Your filing status and tax obligations affect your net disposable income available for support. This includes considering whether you file as single, head of household, or married, as these choices impact your take-home pay.

- Mandatory Retirement Contributions: Required retirement deductions, like pension contributions or mandatory union retirement payments, are considered since they reduce your available income. These aren’t optional expenses you can avoid to increase support payments.

- Health Insurance Expenses: The cost of maintaining health insurance for your children is factored into support calculations. This includes considering who provides coverage and how premium costs are shared.

- Other Support Obligations: Existing court-ordered support payments for other children or former spouses are considered when calculating new support obligations. These prior commitments can reduce the income available for current support calculations.

For example, if you’re a sales executive earning $120,000 base salary plus quarterly bonuses ranging from $20,000 to $50,000, the court won’t simply use your base salary. They’ll consider your total compensation package.

Your base support may be set using $140,000, which includes your base salary and the lower end of your quarterly bonuses, with an additional percentage applied to any bonuses above that amount (see the next section on the Ostler & Smith framework).

The Ostler & Smith Framework

The landmark Ostler & Smith case established how California handles variable income. Rather than setting one fixed amount, courts typically order:

- A base support amount using your guaranteed income

- An additional percentage of bonuses, commissions, or other variable income

For instance, you might pay $2,000 monthly based on your base salary, plus 15% of any bonus or commission you receive.

Income Averaging Methods

Courts typically analyze 12-24 months of income history to establish patterns. Here’s how it works:

A freelance graphic designer’s monthly income over the past year:

- Slow months (4 months): $3,000/month

- Average months (5 months): $7,000/month

- Peak months (3 months): $12,000/month

Annual calculation: ($3,000 × 4) + ($7,000 × 5) + ($12,000 × 3) = $89,000 Average monthly income: $7,416

The court would likely set base support using this average, with provisions for additional support during high-income months.

Base and Supplemental Support Structure

For professionals with variable income, support orders typically include:

- Bonuses

- Commissions

- Profit distributions

- Performance-based compensation

Child Support Based on Income: Special Considerations

Understanding Imputed Income

Courts may use imputed income—your earning capacity rather than actual earnings—when:

- Current earnings are unusually low compared to history

- Recent career changes show potential for higher earnings

- Business expenses appear questionable

- Income reduction appears voluntary

Example: If you’re a medical professional who recently switched to part-time private practice but historically earned $300,000 annually, the court might impute income based on your proven earning capacity.

Self-Employed Professionals

If you’re self-employed, business expenses and deductions are carefully scrutinized. The court distinguishes between true business necessities and personal expenses. Retained earnings, where profits fund future growth, can be contentious, as courts must decide whether to count these as income.

Example: If you’re a consultant reporting $80,000 in net income but showing $40,000 in vehicle expenses, the court may adjust your income for support calculations if personal use is suspected.

Practical Tips for Variable Income Earners

Essential Documentation:

- The past 24 months of income statements

- Tax returns (personal and business)

- Profit and loss statements

- Bank statements

- Investment account statements

- Commission/bonus statements

- Business expense records

Protecting Your Rights While Supporting Your Children

Whether you’re preparing for an initial child support determination or managing existing obligations, understanding how courts handle variable income helps you plan effectively. Our experienced family law team regularly guides professionals through complex child support matters.

Have questions about how your unique income situation affects child support? Contact us for a confidential case evaluation.

Let’s work together to create a child support arrangement that serves your children’s needs while reflecting your professional realities.