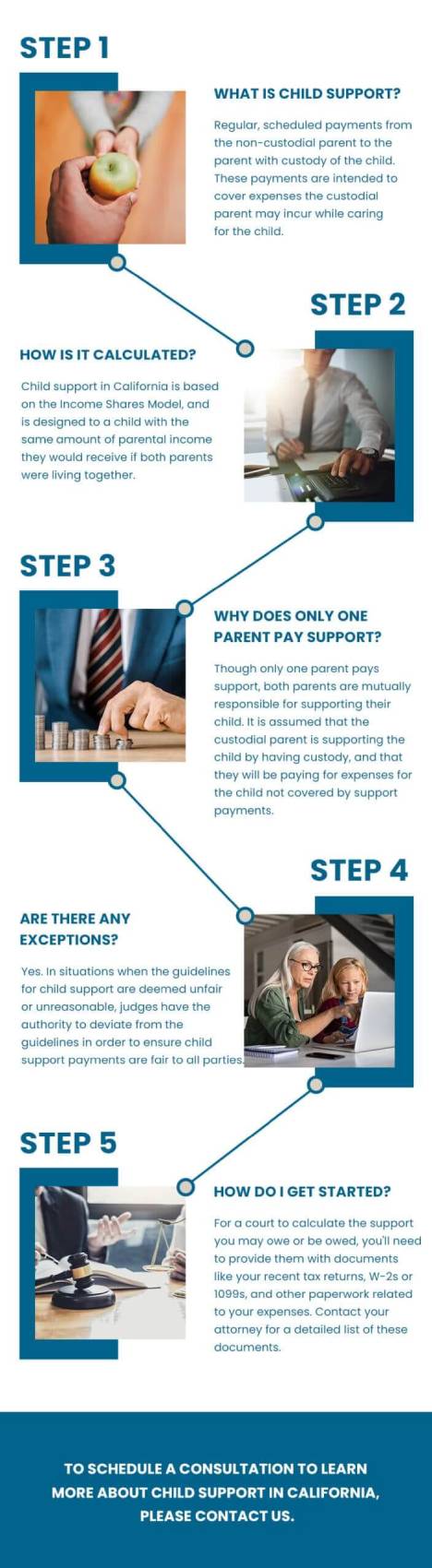

No one enjoys paying alimony to their ex. Sometimes the payment ordered—especially temporary spousal support—can be quite high. Many clients have asked, “Why don’t I just quit my job or take a part-time, minimum-wage position to avoid paying alimony?”

This reaction, though emotional and impulsive, can backfire in significant ways. Let’s explore why quitting your job to avoid alimony is often a terrible idea and what powers the court has to deal with these situations.

Voluntary Unemployment or Underemployment

If you think quitting your job will get you out of paying alimony, think again.

Common examples of voluntary unemployment or underemployment include:

- Intentionally quitting a job

- Taking a lower-paying position without a valid reason

- Refusing promotions

- Avoiding reasonable overtime opportunities

- Claiming inability to work without justification

Courts in California treat these actions as “voluntary unemployment” or “underemployment.” The court can impute income—meaning they will assume you are still capable of earning your previous salary and use that figure to calculate your alimony obligation, even if you are no longer making that amount.

Consider a scenario where you go to the court and say, “I just quit my $100,000-per-year job to pursue my dream of being a fiction writer, please reduce my alimony.” The court can simply respond, “No, you are capable of earning $100,000, and that is the income we will use for calculating your alimony.”

The court’s focus is on your earning capacity, not just your current income.

How the Court Handles Changes in Employment

The court has the power to make certain assumptions about a spouse’s earning potential when determining spousal support. For example, if you voluntarily take a lower-paying job or refuse a promotion, the court can assign an income value to you that reflects what you were making or could reasonably make based on your skills and experience.

The court may even appoint an expert under Evidence Code Section 730 to evaluate your earning potential and use this to determine alimony, regardless of your actual income.

If the loss of income is involuntary—for instance, if you are laid off or fired—the court will consider this differently. As long as you are making reasonable efforts to find similar work, a reduction in income may justify modifying or even suspending alimony. In these cases, the current financial reality will be more heavily weighted by the court.

What About Overtime?

Another common question is whether you are required to keep working excessive hours or overtime to meet alimony obligations. The answer is no. The California Supreme Court in Marriage of Simpson (1992) clarified that overtime or excessive hours are not a requirement for paying spousal support.

Courts consider what is reasonable under the circumstances. If you were working overtime during the marriage, that does not mean you must continue working those hours indefinitely just to pay alimony.

What About Retirement?

If you are approaching retirement and concerned about how it might affect your alimony obligations, it’s important to understand how California courts handle this scenario. In general, you are not required to work indefinitely just to pay alimony.

If you retire at a reasonable retirement age, you can petition the court to modify or terminate your alimony payments.

However, the court will look at several factors, including:

- Age and Health: If you are retiring due to age or health reasons, the court is more likely to be sympathetic.

- Financial Impact: The court will assess how retirement impacts your ability to pay spousal support. If your income drops significantly, you may be able to reduce or terminate alimony.

- Reasonableness of Retirement: The timing and reason for retirement must be deemed reasonable by the court. If you retire early without a compelling reason, the court may still expect you to pay alimony.

It’s important to prepare thoroughly before retiring by documenting your financial situation and consulting with an attorney to present a strong case for modification.

Consequences of Quitting to Avoid Alimony

Quitting your job purely to avoid paying alimony can lead to serious consequences. Courts are well aware of this tactic and have mechanisms to prevent it from succeeding. If you attempt to dodge spousal support by reducing your income voluntarily, the court may:

- Order Wage Garnishment: If you have any remaining income, the court can garnish your wages to fulfill alimony obligations.

- Hold You in Contempt: Failing to comply with an alimony order can lead to being held in contempt of court, which can carry fines or even jail time.

It is crucial to remember that alimony is intended to ensure that both spouses can maintain a reasonable standard of living post-divorce. Courts evaluate the entire financial picture—your income, your ex-spouse’s income, assets, debts, and sacrifices made during the marriage.

Aggressively attempting to avoid payments could end up working against you, especially if the court finds that you are deliberately trying to shirk your responsibilities.

A Balanced Approach

If your financial situation genuinely changes, such as losing your job involuntarily or facing a health issue that prevents you from working, seeking a legal modification of alimony is a far better approach. By demonstrating to the court that the change is beyond your control and providing supporting documentation, you may be able to reduce or eliminate your alimony obligations.

On the other hand, taking drastic actions like voluntarily reducing your income or avoiding career opportunities will not lead to a favorable outcome. Courts will continue to base alimony on your potential income, and you could end up in a worse situation, including legal penalties.

Alternative Solutions for Meeting Alimony Obligations

If you are struggling to meet your alimony obligations, there are alternative solutions that may help you manage your financial situation more effectively. Instead of quitting your job or reducing your income, consider these options:

- Requesting a Modification: If you are experiencing a genuine change in circumstances, such as losing your job or facing health issues, you can ask the court to modify your alimony obligations. This approach is far more effective and legally sound than quitting your job.

- Refinancing Debts: Refinancing existing debts can help lower monthly payments, freeing up money to meet alimony obligations.

- Restructuring Budgets: Carefully reviewing and adjusting your budget can help you find ways to accommodate alimony payments without jeopardizing your financial stability.

- Reaching Amicable Agreements: In some cases, you may be able to negotiate a new arrangement with your ex-spouse. Mediation or open communication can help both parties reach a solution that works better for everyone.

For more strategies to avoid or reduce alimony, see our blog on How to Avoid Paying Alimony in California.

Consult an Attorney Before Making Drastic Changes

If you need advice or want to explore your options for modifying alimony, call us or schedule a case evaluation online today. We can help you understand your rights and make informed decisions that work for your financial future.

Depositions in California Family Law Cases

Worried about a deposition in your California family law case? Learn what to expect, how to prepare, and your legal rights.

Automatic Temporary Restraining Orders (ATROs) in California

Automatic temporary restraining orders (ATROs) restrict finances, custody, & travel. Learn what they cover, when they apply, and how to protect your interests.

Child Custody Schedules by Age: What Works Best for Your Family

Explore child custody schedules by age that support your child’s developmental needs, from infancy to adolescence. Build a plan that truly fits their needs.