Child support is critical to ensuring that children receive the necessary support and care they need after separation or divorce. In California, child support is calculated based on specific legal guidelines that consider various factors such as income, parental timeshare, and additional expenses. Understanding these guidelines can help parents navigate the complexities of child support and ensure that their children’s needs are met.

This blog post will provide an overview of how child support is calculated in California. We will discuss the basic principles of child support, including its importance and purpose, and delve into some key factors in determining child support payments. We will also cover additional expenses, modifications, enforcement mechanisms, and what happens when guidelines don’t apply. By the end of this post, you will have a general understanding of how child support works in California and how it can be managed effectively for the benefit of your children.

Understanding the Basics of Child Support

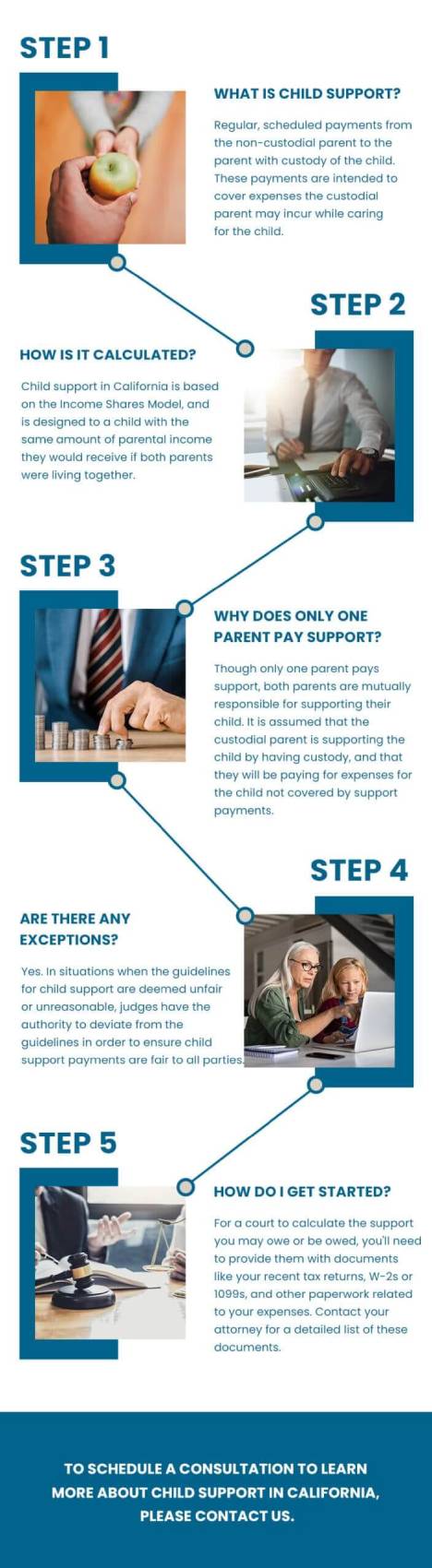

Child support is a legal obligation that ensures financial support for a child. It aims to guarantee that both parents contribute to the child’s expenses. Typically, the non-custodial parent pays child support to the custodial parent. The amount of support is determined based on both parents’ income and the child’s needs. Child support is enforceable by law, and failure to pay can lead to legal consequences. With the help of a child support calculator and following California law, the child support agency determines the amount of support using a guideline formula that considers the parents’ incomes and the child’s needs.

The Importance and Purpose of Child Support

Child support plays a crucial role in the well-being and development of children. It helps cover their basic needs, such as food, clothing, and shelter and contributes to their education and healthcare expenses. The primary purpose of child support is to ensure that children have access to the same standard of living they would have if their parents were together. Additionally, child support provides financial stability for custodial parents, who may face additional expenses in raising a child. By promoting the child’s welfare and assisting custodial parents, child support serves an essential function in our society.

Factors Considered in Child Support Calculation

When calculating child support in California, several factors come into play. One of the key considerations is the income of both parents. The court considers the number of children involved, healthcare expenses, and childcare costs. Another factor considered is the amount of time each parent spends with the child, also known as parental timeshare. The court also considers the parent’s ability to pay and any special circumstances that may impact child support calculations. These factors are all taken into account when using the child support guidelines in California, which provide a formula for calculating child support based on these considerations.

Income Disparity and Its Impact on Child Support

In California, the income disparity between parents can significantly impact child support calculations. When determining child support, the court considers the income of both parents and the needs of the child. The disparity of income is a crucial factor in these calculations. In general, the greater the disparity between the parents’ incomes, the higher the child support obligation. For example, suppose Parent A, who is the higher-earning parent, earns $100,000 per year, and Parent B earns $15,000 per year. In that case, Parent A can expect to pay a significant amount of child support. If Parent A and Parent B have relatively equal incomes, child support will be less. The court may also deviate from standard guidelines when there is significant income disparity. Both parents must provide accurate income information to ensure a fair child support calculation.

The court uses a specific formula to calculate child support, considering various factors such as each parent’s income, tax filing status, and deductions. However, when one parent earns significantly more than the other, this formula may not always result in a fair distribution of support. In such cases, the court may use its discretion to deviate from these guidelines and consider additional factors that could impact the final decision.

It is vital for both parents to provide accurate and up-to-date information about their income and expenses during the child support proceedings. This ensures the court has all the relevant information necessary to make an informed decision regarding child support payments. Failure to disclose complete and accurate financial information could lead to legal trouble and affect the outcome of the case.

In conclusion, California courts consider income disparity between parents while calculating child support payments. Accurate disclosure of financial information by both parties is crucial to ensure a fair calculation of child support that meets the needs of the child and reflects each parent’s financial situation.

Role of Parental Timeshare in Calculating Child Support

When calculating child support, parental timeshare is another crucial factor that plays a significant role. Parental timeshare refers to the time each parent spends with the child and can impact the amount of child support that needs to be paid. The more time a parent spends with the child, the lower their child support obligation may be.

To accurately determine parental timeshare, it is essential to have a well-documented parenting plan or custody arrangement. Accurate documentation is necessary for precise calculations of child support and other expenses. Not considering parental timeshare can result in unfair and inequitable outcomes for both parents and children.

In addition to impacting child support payments, parental timeshare also affects the allocation of other expenses related to the child’s upbringing, such as healthcare and education expenses. Therefore, it is crucial to carefully consider parental timeshare when determining child support obligations. This ensures a just and equitable distribution of resources that benefits both parents and children alike.

If you’re interested in getting a quick estimate on child support for your situation, we have a child support calculator that can provide you with an estimate. While not as accurate as what our attorneys can calculate based on your specific case, many people find it useful!

Additional Expenses in Child Support – Mandatory and Discretionary

In addition to basic child support, there are additional expenses that need to be considered in child support calculations. Mandatory expenses, such as healthcare premiums, childcare costs related to employment or reasonably necessary education or training for employment, and reasonable uninsured healthcare costs for the children, are essential and must be included. On the other hand, discretionary expenses, such as extracurricular activities and educational expenses, may also be taken into account. When determining the allocation of these additional expenses, the court will consider the financial ability of each parent to contribute, including any spousal support (alimony) payments for someone who’s not a part of the current case, such as for children from a previous relationship or an ex from a previous marriage. Parents must discuss these expenses and their allocation with one another or consult a family law attorney to ensure a fair and appropriate arrangement.

How do Shared Parental Responsibilities Affect Child Support?

Shared parental responsibilities have a direct impact on child support calculations. When parents share custody, the amount of child support may decrease. Courts consider the time each parent spends with the child and the parenting plan when determining child support amounts. Joint custody arrangements can influence the calculation process.

When does Child Support Typically Begin and End?

Child support generally starts when parents separate or file for divorce. It continues until the child reaches the age of majority, which is usually 18. However, there are circumstances where child support may extend beyond 18, such as if the child has special needs or is still in high school. Modifying child support orders is possible if there are changes in circumstances.

Modifications in Child Support: When and How?

Child support modifications can be requested when there are significant changes in circumstances. Factors like income changes and healthcare needs are considered. Filing a motion with the court is typically required, along with supporting documentation. A family law attorney can assist with navigating the process of requesting a child support modification.

The Mechanism of Child Support Payment

Child support payments in California are typically made on a monthly basis. These payments can be made directly between parents or through a government agency, such as the local child support agency. It is important to ensure that child support payments are made consistently and on time, as non-payment can result in enforcement actions, such as wage garnishment. The amount of child support is determined by a formula that takes into account various factors, such as both parents’ incomes, the amount of time each parent spends with the child, any court orders regarding payment schedules, and whether or not there are any child support arrears. Keeping accurate records of all child support payments made or received is crucial.

How is Child Support Enforcement Handled in California?

The Department of Child Support Services (DCSS) handles child support enforcement in California. They use various methods to enforce child support orders, such as wage garnishment and intercepting tax refunds. If a parent doesn’t pay support, they may face legal consequences. The DCSS can also help locate delinquent parents.

What Happens When Child Support Guidelines Don’t Apply?

When special circumstances arise, child support guidelines may not apply. In such cases, the court can deviate from the guidelines if it is in the child’s best interest. Factors like high-income earners and shared custody arrangements can affect child support calculations. Consulting a family law attorney is crucial to understanding how guidelines may or may not apply in your situation.

Understanding how child support is calculated in California is essential for both parents involved. Factors such as income disparity, parental timeshare, additional expenses, and shared parental responsibilities play a significant role in determining the amount of child support. It is essential to be aware of when child support typically begins and ends and the process for modifying child support payments. California has mechanisms in place for enforcing child support payments, ensuring the financial well-being of the child. However, there may be situations where the standard child support guidelines don’t apply, and it is necessary to seek legal advice to navigate those circumstances. Remember, providing adequate financial support for your child is crucial for their upbringing and future.