You can’t live forever.

But you can make it easier for your loved ones when you go.

Everyone dies. It’s not fun to talk about and even less fun to plan for, but the truth is — we can’t stop time. Having a secure plan to care for your loved ones and your legacy, though, can bring tremendous peace of mind for you now and a sigh of relief for those tasked with managing your affairs later on.

At Provinziano & Associates, we take great care in helping you develop a legally binding set of instructions for your estate. From straightforward cases to those that are highly complex, we combine local knowledge with decades of experience in wealth protection to build a plan that leaves no stone unturned.

Get a reliable plan, 100% online.

A properly executed estate plan:

✔️provides financial stability for your loved ones,

✔️preserves assets for future generations,

✔️offers support to beloved organizations,

✔️minimizes taxes and expenses, and

✔️ensures that your wishes are followed.

We treat your plan like it’s our own.

Al and Robert have a combined 50 years of experience serving clients in Southern California.

Alphonse Provinziano

Senior Trial Attorney (CFLS)

Alphonse is a Certified Specialist in Family Law by the California State Bar Board of Legal Specialization. He has represented clients in approximately 2,000 legal matters over the past twelve years and has a proven track record of successful outcomes in Court.

After 15+ years of service, Al enjoys the sheer relief his clients experience once they’ve formalized a thoughtfully prepared estate plan.

Robert Vaughan

Title

Bio coming soon.

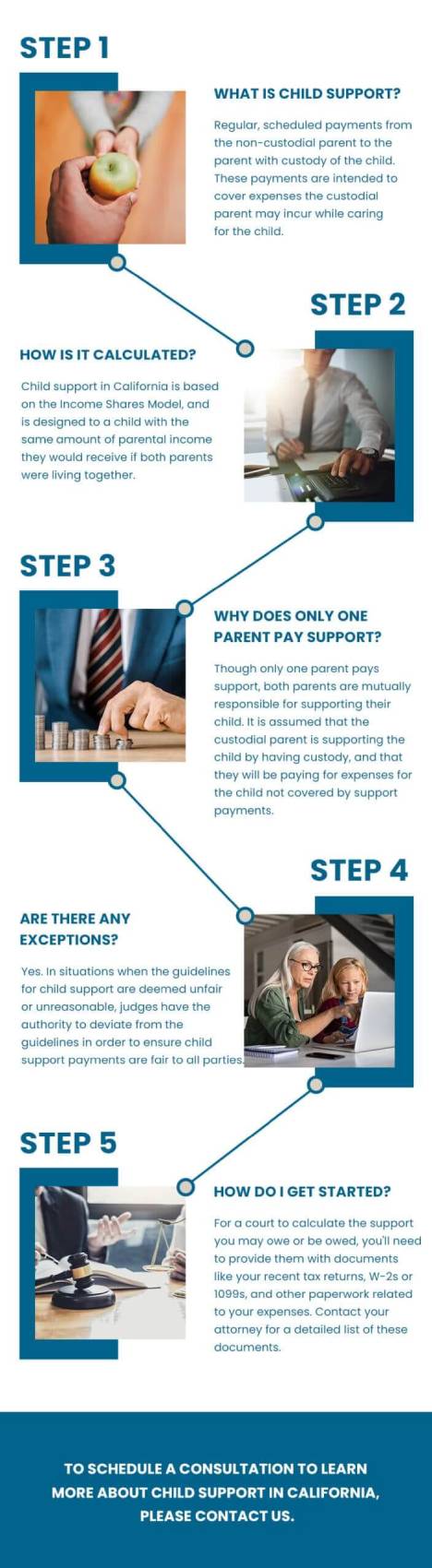

Frequently Asked Questions

What is an estate?

Your estate is everything you possess; your home, car, belongings, bank account, life insurance, etc. It can include a will and/or trusts, as well as a health care proxy and power of attorney.

What happens if I don’t have an estate plan, will, and/or trust?

By default, your state will determine who receives your property when you pass away, based on individual state laws. This leaves no guarantee that your assets will be distributed according to your personal wishes.

Why do I need an attorney?

An attorney can guide you through the multifaceted implications of each option available for estate planning. You will be in control of all decisions, but an attorney can assist you in communicating your wishes for the future clearly and ensure you avoid mistakes. Accurate planning now protects your loved ones and your legacy in the future.

Read More FAQ

What is a trust?

A trust is a legal document laying out plans for the future to ensure your loved ones are taken care of. The grantor can transfer ownership of assets to the trust. It can take effect before death, at death/incapacitation, or afterward. Typically, the grantor designates someone to manage the trust (as trustee) when they die. The trustee distributes assets to the beneficiaries according to the terms of the trust. This keeps the process private, bypasses the probate process, allows the beneficiaries to receive their assigned assets immediately, and eliminates further court or attorney fees once the trust is established.

Are there different types of trusts?

Yes, there are revocable and irrevocable trusts. Revocable trusts can be changed as long as the grantor is living. Irrevocable trusts cannot be changed. Once property is placed there, it belongs to the trust. One benefit of irrevocable trusts is the ability to reduce your estate size and save on taxes.

What is included in a trust?

Most any asset, including real estate, bank accounts, cars, personal property, etc. can be placed in a trust. It does not include your retirement account or health savings plans, or guardianship plans for minor children. A trust can only control assets that have been placed into it, empty trusts hold no value.

What is a will?

A will is a legal document stating how you want your assets distributed and affairs handled when you’re gone. It is controlled by the probate court and only takes effect after death. If you’re incapacitated, your assets will be in the hands of the court. It is revocable while the grantor is alive. Typically, wills name a designated executor to help carry out provisions when the grantor is deceased. Wills also include guardianship provision for minor children, specific funeral arrangements, etc.

What role does the probate court play in estate planning?

Probate court is responsible for settling wills, estates, conservatorships, and guardianships. The court confirms validity and ensures that assets get distributed according to the wishes of the deceased. Court records are public, giving opportunity for excluded heirs to seek a share of the estate.

Leave the legacy you want.

Testimony 1

Testimony 1

Testimony 2

Testimony 2

A simple process

that covers every detail.

All aspects of the process can be completed from the comfort and safety of your home.

Determine Your Wishes

We’ll begin the process with a secure virtual call to discuss your goals, how you wish to distribute your assets, who you want to handle your estate, and any concerns you have.

Develop Your Custom Plan

Once we have the necessary data together and a clear understanding of your desires for the future, we’ll put your estate plan on paper and then do a joint review and edit via virtual call.

Organize Intricate Details

Together, we’ll go over the specific details of your circumstances, gather necessary documents and financial data, and discuss which strategies best suit your wishes and needs.

Make it Official with Confidence

Sign your final copy electronically and complete your plan, from the comfort of home. Rest assured that your future is in order, according to your desires, and review or make changes to your plan any time you wish.